Today we start a blog series dedicated to unpacking the FY 2022 SNF PPS Proposed Rule that was released late in the day on April 8th. CMS has proposed many significant initiatives that will affect every aspect of Skilled Nursing Operations in the coming months and years to come.

This first blog will address the most anticipated aspect of the proposed rule, the parity adjustment, and one that must be explored beyond the headlines of the last few days.

As you may be aware, when the Patient Driven Payment Model (PDPM) went into effect in October, CMS anticipated that it would implement in a budget neutral manner. That means that CMS anticipated that it would spend $0.00 more relative to the way that facilities were paid under the outgoing RUG system. As CMS has admitted in the proposed rule, they were way off.

PDPM was developed using data collected about utilization under a RUGs based system. And even with some sophisticated math and analysis, with the shift in Utilization under PDPM, the reality of budget neutrality was quickly lost in the dust.

As it stands in the Proposed Rule, CMS has determined, through budget neutrality analysis, that even absent COVID related cases in 2020, i.e. active COVID dx. and or use of the 3-day stay waiver, there was a 5.0% increase in aggregate spending under the PDPM for FY 2020 due to the shift in case mix utilization, not the least of which was the significant reduction of individual therapy minutes and increase in group and concurrent minutes at the outset of PDPM.

Many of us who have been following the data recognized early on that this was the case and have expected the response in this year’s proposed rule. What is that response? CMS has proposed a Parity adjustment to the Case Mix Indexes for all 5 PDPM payment categories. That’s right, CMS in some shape or form intends to adjust the CMI for each HIPPS group under PDPM to offset this 5.0% increase and bring spending for Part A in SNFs back into line where they expected it to be in the fall of 2019.

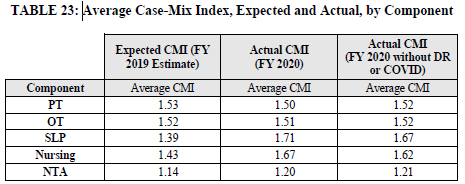

The following table shows where the biggest shifts in utilization have occurred since the PDPM implementation. Every category contributed to the increase spending and so each case mix group will feel the effects of the parity adjustment.

How CMS will implement this adjustment remains to be seen. The proposed rule seeks stakeholder comment on 3 possible scenarios.

Delayed

-

If this reduction was finalized in FY 2022 with a 1 year delayed implementation, this would mean that the full 5 percent reduction would be prospectively applied to the PDPM CMIs in FY 2023.

-

If the reduction was finalized in FY 2022 with a 2 year delayed implementation, then the reduction in the PDPM CMIs would be applied prospectively beginning in FY 2024.

Phased

-

With regard to a phased implementation strategy, this would mean that the amount of the reduction would be spread out over some number of years. Such an approach helps to mitigate the impact of the reduction in payments by applying only a portion of the reduction in a given year. For example, if we were to use a 2-year phased implementation approach to the 5 percent reduction discussed above, this would mean that the PDPM CMIs would be reduced by 2.5 percent in the first year of implementation and then reduced by the remaining 2.5 percent in the second and final year of implementation. So, for example, if this adjustment was finalized for FY 2022, then the PDPM CMIs would be reduced by 2.5 percent in FY 2022 and then reduced by an additional 2.5 percent in FY 2023.

-

CMS notes that the number of years for a phased implementation approach could be as little as 2 years but as long as necessary to appropriately mitigate the yearly impact of the reduction. For example, we could implement a 5-year phased approach for this reduction, which would apply a one percent reduction to the PDPM CMIs each year for 5 years.

The Combo

-

CMS also notes that these mitigation strategies may be used in combination with each other. For example, we could finalize a 2 year phased approach with a 1 year delayed implementation. Using FY 2022 as the hypothetical year in which such an approach could be finalized, this would mean that there would be no reduction to the PDPM CMIs in FY 2022, a 2.5 percent reduction to the PDPM CMIs in FY 2023 and then a 2.5 percent reduction in the PDPM CMIs in FY 2024.

CMS finally indicates that,

We are considering these approaches as they may be warranted to mitigate potential negative impacts on providers resulting from implementation of such a reduction in the SNF PPS

rates entirely within a single year in the event we determine that recalibrating the parity adjustment is necessary to achieve budget neutrality. However, we believe that these alternatives would continue to reimburse in amounts that significantly exceed our intended policy in excess of the rates that would have been paid had we maintained the prior payment classification system rather than in a budget neutral manner as intended, and as we stated above, we believe it is imperative that we act in a well-considered but appropriately expedient manner once excess payments are identified.”

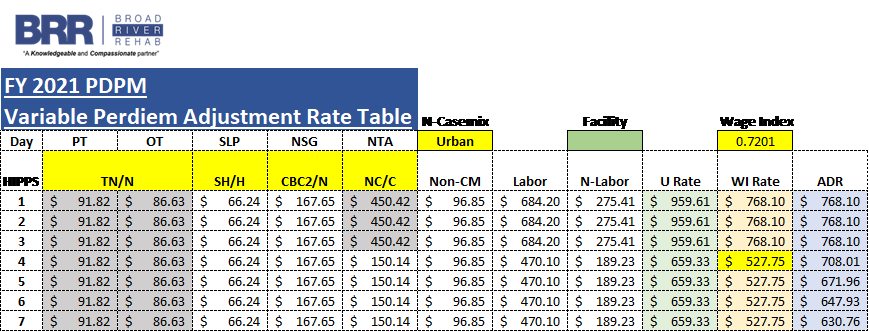

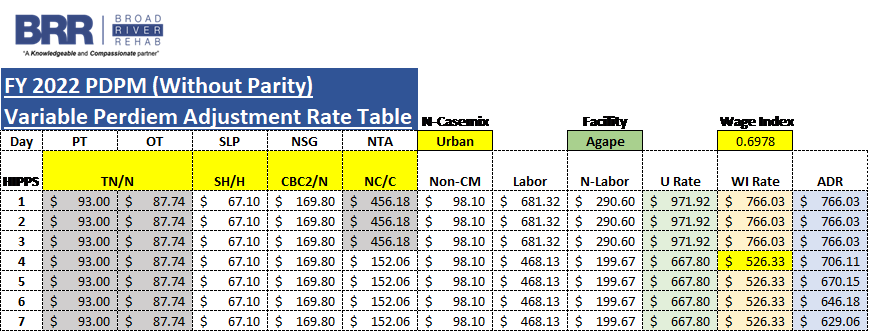

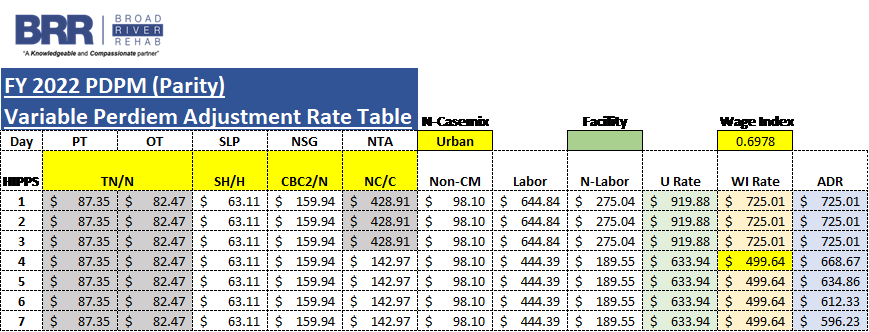

Regardless of the approach there will be an adjustment. Here is an example facility that shows Current rates, FY2022 rates and FY 2022 rates with the 5% parity adjustment. It is sobering. You will note that from FY 2021 to FY 2022 parity there is an average $34.53/day reduction in the first 7 days relative to FY 2022 rates published with this proposed rule.

We will talk more about the wage index differences you may have noticed in the above rate tables in a future blog in this series. This has some impact on the rates, but by far the parity adjustment stands to have the biggest impact over time.

Ensuring that you understand PDPM and are getting the appropriate reimbursement for the unique residents you care for is paramount as we face these impending adjustments. It’s time to be prepared.

We encourage everyone to offer comment on this proposal. CMS will accept electronic comments through 5 pm EST June 7th, 2021 at http://www.regulations.gov Follow the “Submit a comment” instructions.