CMS FY 2021 will be here in a few short days and with it the changes that have been finalized by CMS in the final rule on July 31st. One of the important changes that will occur this year has to do with the wage index.

The wage index is an adjustment made to the labor portion of the federal PPS base rates and is based on geographic variation in wages using regional hospital wage data. From time to time CMS updates the geographical delineations that determine the hospitals from which the wage index data is derived.

To understand how the wage index affects your PPS rate a primer on how PPS rates are constructed under PDPM is necessary. Facilities that are paid by Medicare Part A for skilled services are paid based on a HIPPS code that is determined by services provided as recorded in the Minimum Data Set.

The HIPPS code is a 5-character code that indicates the case mix classification for the 5 components that make up the PDPM rate; character 1 – PT/OT, Character 2 = SLP, Character 3 = Nursing , Character 4 = NTA and Character 5 = Assessment type. For example, A HIPPS code of NHNC1 indicates that PT/OT will be paid at the following case mix groups; PT/OT – TN, SLP – SH, NSG – CBC2, NTA – NC, for a 5-day PPPS assessment – 1.

Each of these components is based on federal base rate that CMS sets each year. This year the base rates received a 2.2% increase from the prior year. The base rates for FY 2021 PPS rates are as follows.

| Nursing | NTA | PT | OT | SLP | Non-Casemix | |

|---|---|---|---|---|---|---|

| Urban | $108.16 | $81.60 | $62.04 | $57.75 | $23.16 | $96.85 |

| Rural | $103.34 | $77.96 | $70.72 | $64.95 | $29.18 | $98.64 |

Each of the HIPPS code indicators also has a case mix index, or acuity index, associated with it that is then multiplied by the federal base rates in the table above to form the PPS rate specific to that code. For example, the HIPPS noted above, NHNC1 has the following case mix indexes, PT (N) – 1.48, OT (N) – 1.50, SLP (H) – 2.86, NSG (N) – 1.55, and NTA (C) – 1.84.

Using the table above, for an Urban facility, these then would be the specific rates. PT – $91.82, OT – $86.63, SLP – $66.24, NSG – $167.65 and NTA – $150.14

After the rates are determined they are added together to from an unadjusted rate. For the example we are working with, the unadjusted rate is $959.61. This unadjusted rate is then divided into labor related and non-labor related portion. The labor related portion is the unadjusted rate multiplied by the current labor related relative importance factor, which for FY 2021 is 0.713. Applying this to our example we arrive at a labor related portion of the rate of $684.20. The remainder, or non-labor related portion of the rate, is $275.41.

Finally, we can now apply the wage index adjustment to the rate. Current wage index data for your facility may be found here.

In Practice

Here is how it works. The labor related portion of the rate is adjusted using the facility specific wage index. In our example let’s use a wage index that is associated with Frederick County MD which is 0.9834. Using the labor related portion – $684.20 x the wage index 0.9834 = 672.84. This adjusted labor related portion is then added back to the non-labor related portion to form the final wage index adjusted rate, i.e. $672.84 + $275.41 = 948.25 for day’s 1-3 of the SNF stay.

It is important to remember that in the FY 2021 SNF PPS Final rule, CMS has finalized adoption of the revised OMB delineations identified in OMB Bulletin No. 18-04 in order to identify a facility’s urban or rural status: The OMB Memo may be found here.

CMS believes that these updated OMB delineations more accurately reflect the contemporary urban and rural nature of areas across the country, and that use of such delineations would allow them to more accurately determine the appropriate wage index and rate tables to apply under the SNF PPS, in order to enhance the accuracy of payments under the SNF PPS.

Changes to the OMB statistical area delineations include some new CBSAs, urban counties that would become rural, rural counties that would become urban, and existing CBSAs that would be split apart.

The important thing to understand about this year’s changes is that some facilities will have a significant change to their wage index due to a change in their urban or rural status. To lessen the blow to facilities whose wage index will decrease, CMS has finalized a 1-year transition for FY 2021 under which they will apply a 5% cap on any decrease in a SNFs wage index compared to its wage index for the prior fiscal year (FY 2020).

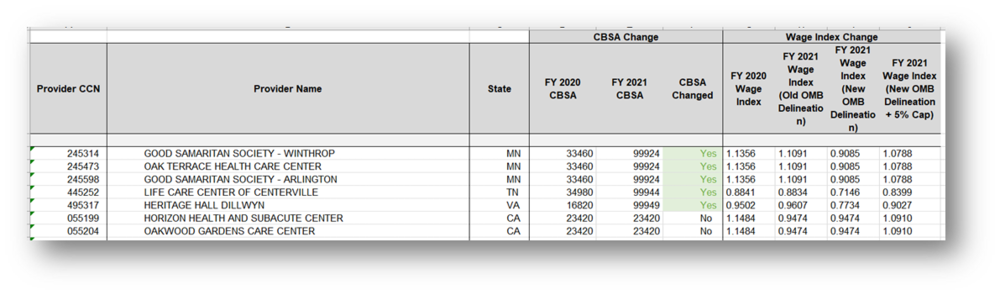

Here is an example from the wage index website noted above. Note that the first three facilities in this list have a wage index this year, FY 2020, of 1.1356. With the changes that CMS will apply to the FY 2021 wage indexes based on the new OMB geographical delineations, these facilities will have a significant reduction to their wage index come Oct. 1st. Their new wage index for FY 2021 would be 0.9085. However, with the 5% cap in place, they will be assigned a wage index for FY 2021 of 1.0788. Then, next year, FY 2022, they will be assigned the fully reduced wage index.

click to enlarge

The wage index table located at the web link noted above is a spreadsheet that has three important tabs labeled Table A, Table B and Supplemental Data. Table B lists all of the states and territory’s Rural wage indexes. If you are a in a geographical location that is delineated as Rural by the OMB, this is where you will find your wage index.

Table A lists all Urban delineated counties and their respective wage indexes. It is important to note that the wage indexes in Table A, the table most have relied on for their wage index data, have not been adjusted relative to the 5% cap noted above. Rather that wage index, the actual wage index that will be applied to the labor related portion of the FY 2021 PPS rate, can only be found in the tab labeled Supplemental Data. The graphic above illustrates what you will see in the Supplemental Data tab. The Supplemental Data table lists data by facility so your wage index data will be easy to find.

You will be well served to review the Supplemental Table to determine the facility specific wage index data that will apply to your rate starting on October 1st. You may have an increase and that’s good. However, you may have a decrease to which the 5% cap will be applied. It will be good to know how these changes will affect your rate before you receive your first remittance advice statements for services billed after October 1.