It’s springtime and that means rain and wind and blustery weather as winter gives up the ghost and warmer days approach. The spring ritual of shedding the heavy outer garments and donning more comfortable seasonal attire has begun.

It’s also time for another early spring ritual. Every year around this time. CMS publishes the proposed rule for the upcoming fiscal Year. Some are more exciting than others. The FY 2025 proposals contain some zingers, in particular, the proposed wage index changes.

Hospital Wage Data

CMS is proposing to continue to use hospital wage data for setting wage indexes for FY 2025. CMS continues to believe that in the absence of SNF-specific wage data, using the hospital inpatient wage index data is appropriate and reasonable for the SNF PPS.

This is not new but continues to be a thorn in the side of SNFs as Hospital wage data is not necessarily a good proxy for SNF wages. CMS’ reasoning is that it would be time and cost prohibitive for CMS and providers, to do a SNF specific wage analysis.

CBSA Changes

The biggest wage index news coming out of this proposed rule is that CMS has opted to update the Core Based Statistical Area (CBSA) data. If finalized, this will have a significant effect on wage index changes for FY 2025.

The applicable SNF PPS wage index is assigned to a SNF using the area hospital labor market. On July 21, 2023, OMB issued Bulletin No. 23-01 which updates CBSA data from Bulletin No. 20-01 based upon the 2020 Standards for Delineating Core Based Statistical Areas.

The revisions OMB published on July 21, 2023 contain a number of significant changes. For example, under the proposed revised OMB delineations, there would be new CBSAs, urban counties that would become rural, rural counties that would become urban, and existing CBSAs that would split apart.

CMS believes the delineations reflected in OMB Bulletin No. 23-01 better reflect the local economies and wage levels of the areas in which hospitals are currently located, is proposing to implement the revised OMB delineations as described in the July 21, 2023 OMB Bulletin No. 23-01, for the SNF PPS wage index effective beginning in FY 2025.

The 5% Cap

In addition, CMS will continue to apply the permanent 5 percent cap policy in FY 2025 on decreases in a hospital’s wage index compared to its wage index for the prior fiscal year (FY 2024) to assist providers in adapting to the revised OMB delineations.

In effect, this means that regardless of the reason a provider’s wage index might decrease more than 5% from one FY to the next their new wage index will never be less than 5% compared to the prior FY. With the proposed FY 2025 CBSA changes there are many facilities that will be capped at 5%.

Statistics

With all of these changes afoot, let’s see some numbers to gain perspective on the impact these proposals could have.

Impact of FY 2025 Proposed Wage Index Changes

| Impact | Stats |

| All Counties (3222) | |

| Counties that changed from Uban to Rural or from Rural to Urban | 108 or 3.3% |

| Urban Counties that would become Rural | 54 or 1.7% |

| Rural Counties that would become Urban | 54 or 1.7% |

| Counties that would experience a CBSA name change | 360 or 11.0% |

| Counties that would change CBSAs | 197 or 6.0% |

| 5% Capped | 195 or 6% |

| Negative WI change | 1335 or 41% |

| Positive WI change | 1887 or 59% |

| WI diff Spread | 50.28% to -37.73 |

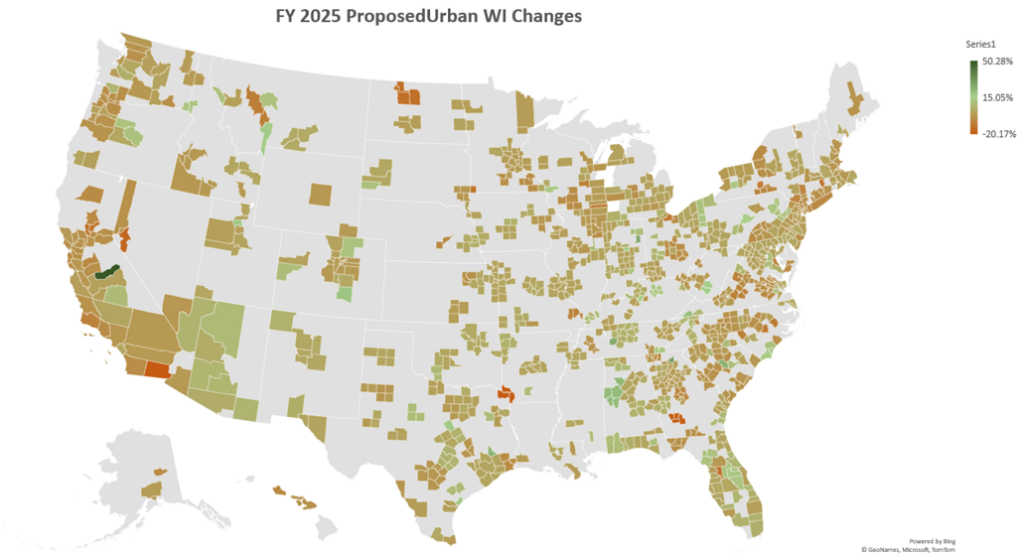

| Urban Counties (1252) | |

| 5% Capped | 82 or 7% |

| Negative WI change | 568 or 45% |

| Positive WI change | 684 or 55% |

| WI diff Spread | 50.28 to -20.17 |

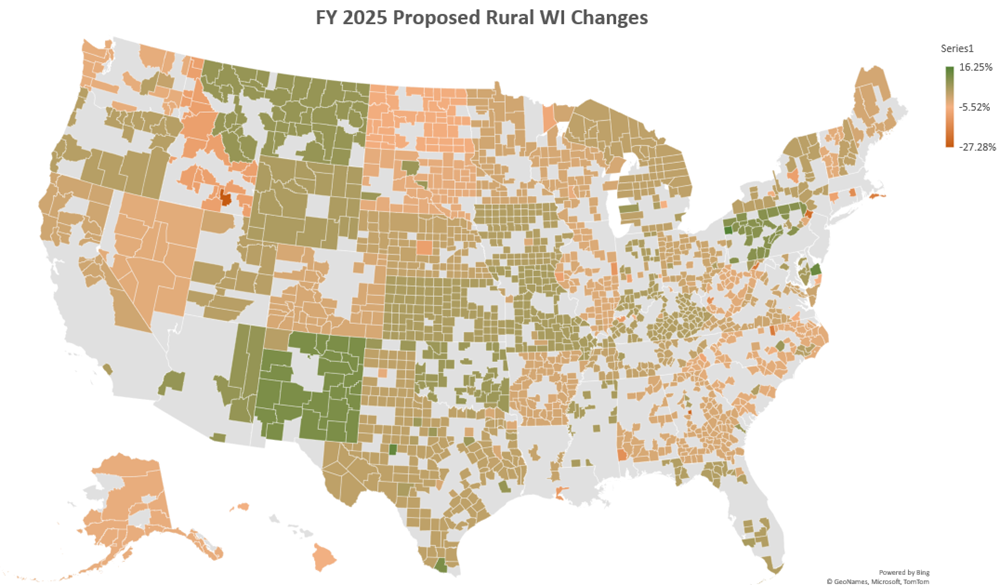

| Rural Counties (1970) | |

| 5% Capped | 113 or 6% |

| Negative WI change | 767 or 39% |

| Positive WI change | 1203 or 61% |

| WI diff Spread | 16.25 to -37.73 |

For a visual, here are a few maps that show the Urban and Rural shift ranges.

Final Word

There is a silver lining, even with the wide swings in wage indexes that are being proposed for FY 2025. According to CMS analysis, no county will experience a rate decrease. This is because CMS is proposing a 4.1% increase in the PDPM rates for FY 2025. That, coupled with the fact that the wage index, no matter how far it swings to the negative as a result of the proposed CBSA changes, will always be capped at 5% of the previous year’s wage index. Even at -5%, the wage index only adjusts 71.9% (labor related portion) of the rate. That’s good news.

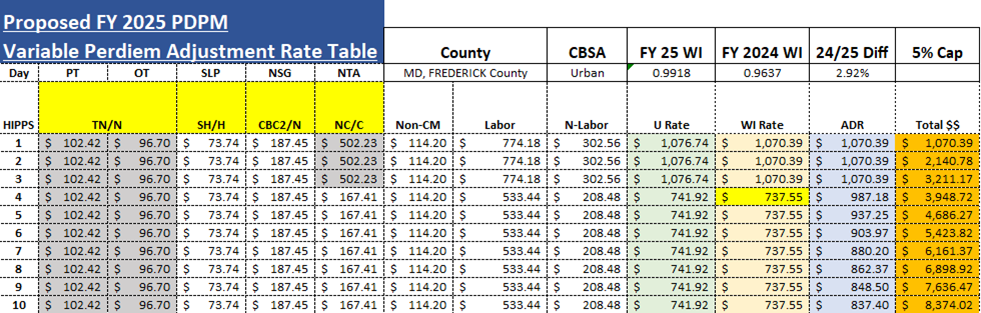

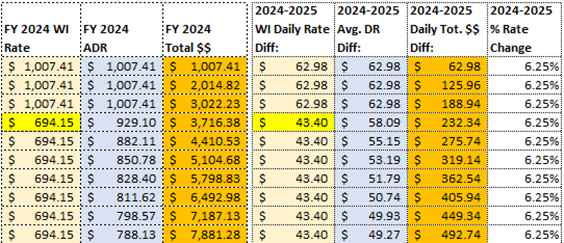

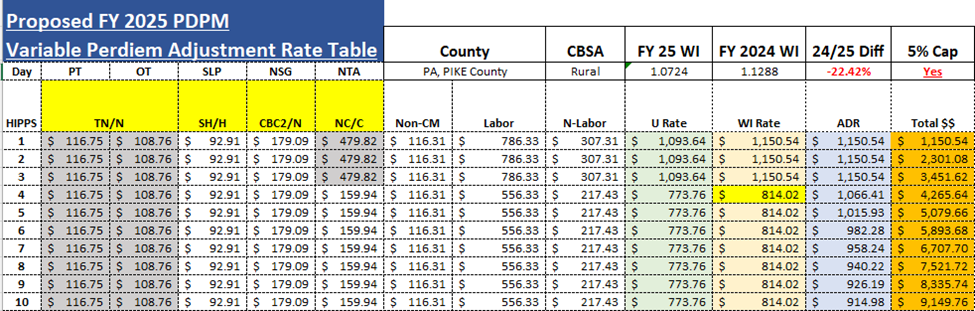

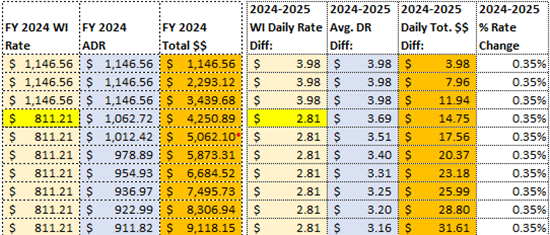

Her are a few rate tables to demonstrate.

The first table represents the CBSA that CMS chooses to use as a comparison in their rule making each year. You will note that this county, Frederick County MD, has a proposed 2.92% increase in their wage index. Along with the proposed 4.1% rate increase, this county will end up with 6.25% added to their rate compare to FY 2024.

The second table represents the CBSA that changed from Urban to Rural, and had a CBSA number and name change as well. Consequently, you will note that the WI had a negative 22.42% change from FY 2024 to FY 2025. However, with the hard 5% cap policy in place, this county will experience only a 5% reduction in their WI. Along with the proposed 4.1% rate increase, this county will still end up with 0.35% added to their rate compared to FY 2024.

The winds of change are blowing. Warmer days are on their way. The FY 2025 proposed rule has come in like a storm. There is much we will have to assimilate to if these proposals are finalized. One change that seems to be headed in the right direction is the proposed WI changes. At least no one is slated for a major rate reduction. That should be good news for most of us.