I am sure you have heard something like this, “we are living in unprecedented times”. Who would have imagined 2 years ago that we would face the demons of a global pandemic with all its implications and ramifications? It’s exhausting just thinking about the work that has been accomplished saving lives, caring for the isolated and comforting those who have experienced loss.

There has been so much we have learned throughout the last 2 years, particularly as it pertains to the daily operations of our communities, things we have never had to consider on such a grand scale before like the amount of PPE we have had to acquire, isolating multiple residents for exposure to or actually having active COVID-19, having to staff separate COVID units, having to staff regular units, accommodating staff who have been exposed to or having active COVID-19, focused infection control surveys, trying to decide if the “waiver” applies, and the list goes on.

Considering all of this, no one denies that there will have to be changes made to how post-acute care happens in the future. Much has been made about survey process inadequacies, current infection control requirements and practices, staffing ratios and competencies, nursing home building design, lack of substantive incentives in the current VBP and QRP, payer source shifts, competition with the concepts of, “SNF at home”, and so on.

And all of this on the heels of a new payment system for Part A called the Patient Driven Payment Model or PDPM. October 2019 was a hallmark date in SNF history as we can all agree that it has been providential that this new payment system came along when it did. Imagine having to traverse the last two years without a payment system that takes into account resident specific characteristics to determine payment. No one denies that RUG IV would have been a complete failure as a payment system in times like these.

PDPM was designed to help providers make better care decisions precisely because reimbursement follows resident characteristics and eerily seems to have been implemented in anticipation of a situation like COVID-19. COVID-19 would have had an even larger impact on providers’ bottom line without PDPM. Even before COVID emerged many, if not most, providers were doing better financially under PDPM than they did under the legacy RUG system due to how PDPM was designed. As providers have become more adept at this payment system, that reality has become even more evident.

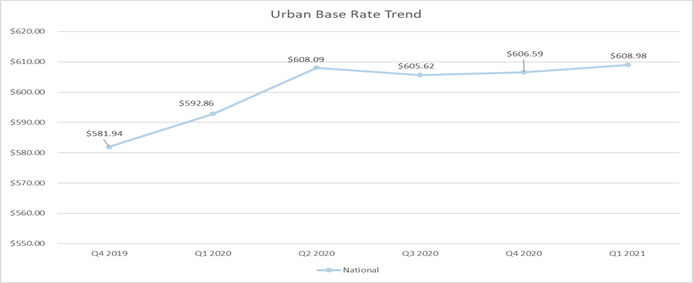

Notice the table below as average base rates have crept up over the 6 quarters for which CMS RESDAC data is available. Provider are learning the new system despite the plateau that seems to follow the high COVID quarters. CMS has taken note. In the FY 2022 rule making process, CMS indicated that, even with the COVID effect, i.e., waiver use, added covid expenditures like increased representation of isolation in the HIPPS, the budget neutral implantation of PDPM they anticipated did not occur to the tune of about a 5% overpayment compared to RUG IV.

Without wage index and VBP adjustments, currently the highest paying HIPPS is DLAA at $1654.55 for days 1-3 and $1119.17 days 4 – 20. In the old RUG days, the highest possible rate was RUX at $ 832.61. Pragmatically, providers billed the RU category more often without the extensive services added so the max at RUC was $631.22. That’s quite a disparity with lots of variation in between. It has generally not been surprising that payments under PDPM have been higher that under RUG IV.

The culprit CMS is focusing on is the non-Covid related increased HIPPS utilization, i.e., non-Covid related elements within the HIPPS that have increased in utilization since October 2019 relative to RUG IV. In the FY 2022 final rule CMS made it plain that they intend to recalibrate these rates to budget neutrality relative to RUG IV payments. While no action was taken this FY, CMS has indicated that they ae not convinced that the uptick in SNF payments is entirely related to the COVID effect to the tune of $1.7 billion or 5%. That seems to be the amount they are convinced will produce parity and reset current SNF payments back to a budget neutral state. How this will occur remains to be seen.

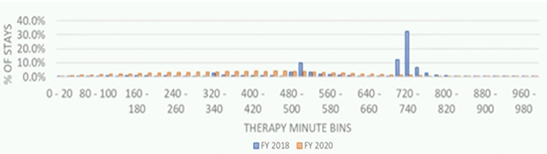

While original concerns seem to center around a 30% decrease in therapy minutes, current CMS conversations indicate a slightly different bent. Related to current therapy distributions which have normalized compared to RUG IV, in a recent presentation CMS officials stated that the, “…normal distribution” is, “…exactly what we were hoping to see that would occur under this new model because what a normal distribution tells me at least is that the amount of therapy that’s being provided to a particular beneficiary is not related in any way to some weird artifact of the payment system but rather is related to that specific patient achieving their specific goals”. “That normal distribution, that varied distribution, is highly indicative of the fact that therapy provision under PDPM seems much more closely connected with unique patient needs and the unique characteristics and goals of that patient rather than some weird artifact of the payment model.”

From this presentation, it seemed less like the bull’s eye is on therapy minutes but on goal achievement within the new distribution and on other potentially inappropriate PDPM metrics and waiver use. While considering future adjustments to the payment model CMS officials have indicated that the data may lead to a consideration of whether, “…is it still appropriate to combine the two components (PT and OT) or should we consider separating those off, are there changes that we could consider making in the nursing component in relation to things in the post-pandemic world, are there changes in the NTA component as we move into this new world in terms of monoclonal antibodies… are there things that we can do to PDPMs overall structure given this new paradigm?” In the context of this discussion, they also noted that there are other areas of program integrity that CMS could be focusing on that will be driven by this data.

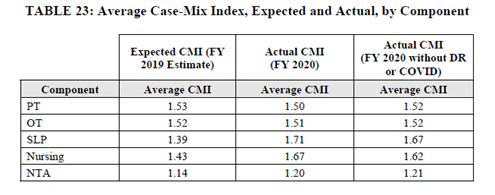

Considering the increased CMI noted by CMS in the SLP, Nursing and NTA categories and shown below in table 23 from the FY 2022 final rule, it is becoming increasingly clear that CMS is eying other areas of the PDPM growth over RUG IV to potentially audit and or adjust related to future payments and parity adjustments.

Taking all of this into consideration, what seems to be rising to the surface is a focus on outcomes and value. In recent discussions CMS has also alluded to the fact that, while therapy minutes have dropped by 30% nationwide since the implementation of PDPM, there is a normal distribution of minutes with its seemingly positive ramifications as noted above. Still, in CMS’ estimation, while this may be a good thing they are designing ways to combine outcomes and financial incentives. If outcomes have stayed the same or improved in aggregate, despite the decline in minutes, then the assumption is that care is being delivered relative to the patient’s unique clinical characteristics and needs and positive outcomes will follow.

Value based purchasing, therefore, is about to undergo an overhaul as the final rule and our prior blogs have enumerated. Two inseparable friends have emerged in this conversation that cannot be ignored in their designed partnership. The SNF Quality Reporting Program and Value Based Purchasing can no longer be viewed as independent entities.

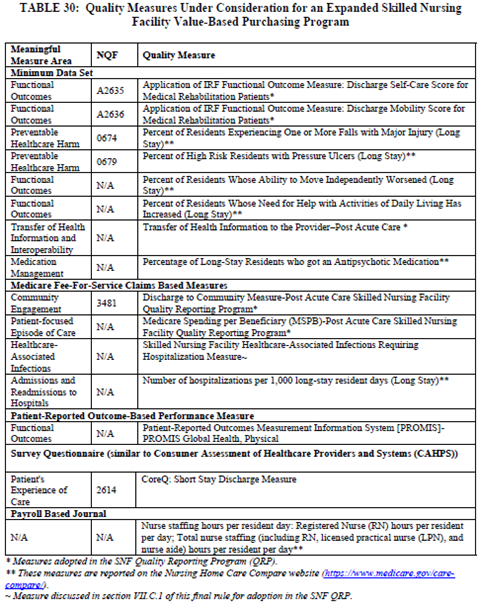

QRP measure reporting will still be tied to a reduction in the annual market basket update. However, in the expected changes to the VBP program the CMS has been given the statutory authority to apply up to 9 additional measures determined appropriate, which may include measures of functional status, patient safety, care coordination, or patient experience. Here is the table from the FY 2022 final rule that lists potential additional VPB measures. Note Meaningful Measures domains and the applicable QRP presence. Also note one other measure that is not included in this table that CMS has indicated they are interested in measuring is staff turnover.

In addition, CMS is also considering expanding the SNF VBP measure set to assess the quality of care that SNFs provide to all residents of the facility, regardless of payer, and has indicated that this would best represent the quality of care provided to all Medicare beneficiaries in the facility. This would be quite a shift from the current Part A only measurement standard for the VBP program and SNF QRP.

While we don’t know for certain what measures will be adopted in the expanded VBP program or when other payers will be in play, the fact that CMS is combining the VBP program with elements of the SNF QRP is a portent of how CMS is defining the role of how these two programs should work to incentivize SNFs in their pursuit of quality. Since the VBP program will continue to adjust SNF payment, expanding not only the measures, but also those who will be measured, could have much more of an impact on payment than the singular rehospitalization rate currently does, i.e., 2%.

All this to say that increased CMS’s decision to recalibrate the PPS to budget neutrality, HIPPS utilization, decreased therapy with normal distribution and the emerging inseparable friends QRP and VBP all combine to create a milieu that demands attention to quality. When these concepts first emerged in the early 2000’s we used to refer to this as a future concept called “Pay for performance”. The future is here, and we now know it as Value Based Purchasing. This is what the data is telling us if we have ears to hear.