In a recent blog post that I read by Brad Hirschfield he said, “We’re all familiar with the expression about missing the forest for the trees, and its wisdom about not being distracted by smaller details that undermine our appreciation of the “big picture.” No doubt, that’s often good advice. After all, who among us hasn’t gotten bogged down in the details of a situation or a relationship, to the point that we lose touch with the larger purposes which give meaning to those very details? On the other hand… What about the wisdom that comes from attending to the “trees” even when the “forest” seems to be coming apart?”

As I read that, I couldn’t help thinking about all that has shifted and changes for us in the LTC industry over the last 18 months and how what we have to contend day to day, the trees, can very well distract us from the larger picture of an industry that has undergone and continues to undergo seismic changes in particular related to the Conditions of Participation and Medicare reimbursement/PDPM, the forest. Yes, there is wisdom in attending to the trees, and this must be done. On the other hand… our ability to attend to the trees depend much on our understanding of the forest as a whole.

The FY 2022 SNF PPS Final Rule was posted on July 29th. As I have been digesting it there is much in this this 290-page document that will shape not only how we function relative to Medicare Part A in our SNFs starting on October 1st but for many years to come. The first larger picture issue that has interested me in this year’s rule making process is the wage index.

Last year, CMS adopted an updated analysis completed by the Office of Budget Management (OMB) which adjusted Core Based Statistical area, or CBSA, delineations. These are the geographical and population indicators that determine a facility’s urban or rural status applicable to their wage index. Many facilities were affected by the OMB CBSA changes. Some facilities that were urban became rural and visa versa. Other counties were split to contain both urban and rural delineation. Still there were other CBSA’s that changed name or number and Urban counties that would move to another Urban CBSA. In many respects it was the wild west.

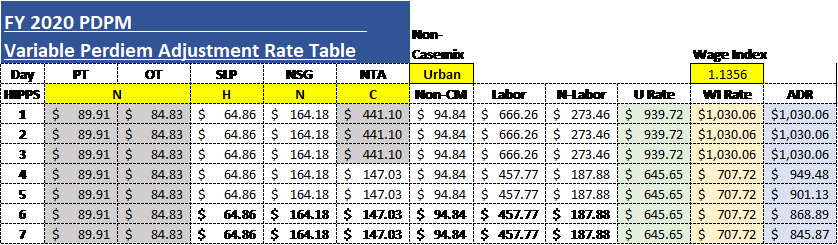

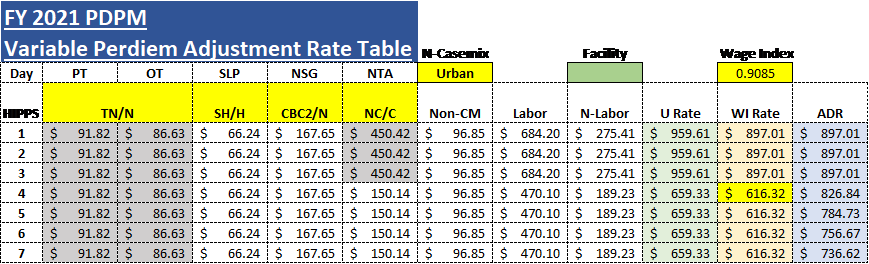

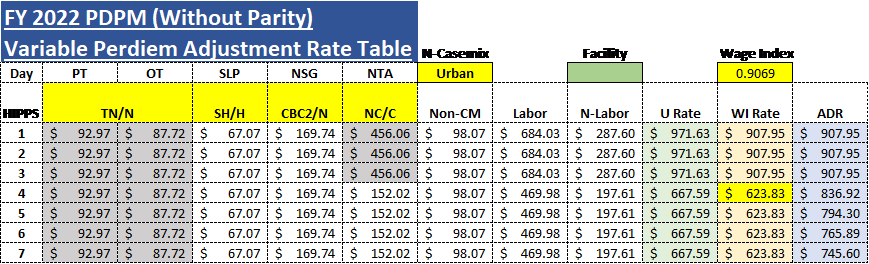

The changes were so significant for some areas that CMS provided an adjustment in the final rule last year that included a 1-year transition that applied a 5% cap on any decrease in a CBSA’s wage index compared to its wage index for the prior FY, 2020. There were about 370 facilities to which the 5% cap applied, i.e., the change in those facility’s wage index was 5% or greater due to the OMB CBSA adjustments. The biggest change occurred in a Sibley County Minnesota. Prior to the OMB CBSA changes This county was urban with a wage index of 1.1356. With the application of the new OMB CBSA delineations, those areas changed to a rural designation with a revised wage index of 0.9085. That is a -20.1% reduction in the wage index alone, overnight. Here is what that looked like in actual rate changes for those facilities.

FY 2020 Rate

FY 2021 Rate with revised OMB CBSA delineations

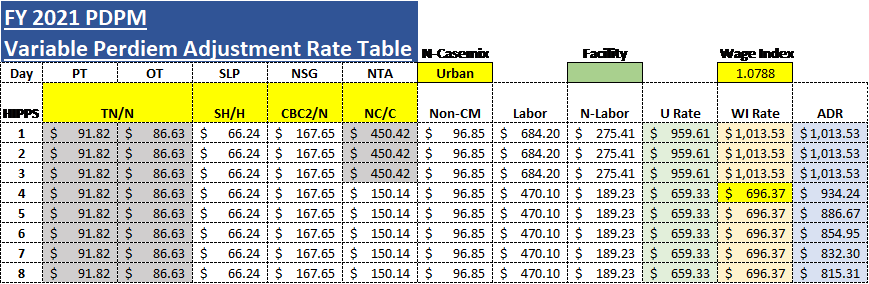

Fortunately, for facilities in that county, CMS capped that reduction at 5% leaving them with a wage index of 1.0788 for FY 2021. Note that the rate change with the 5% cap applied was not as severe as if it had not been applied. This was a helpful transition that CMS incorporated into last year’s rate.

FY 2021 rate with 5% rate cap applied

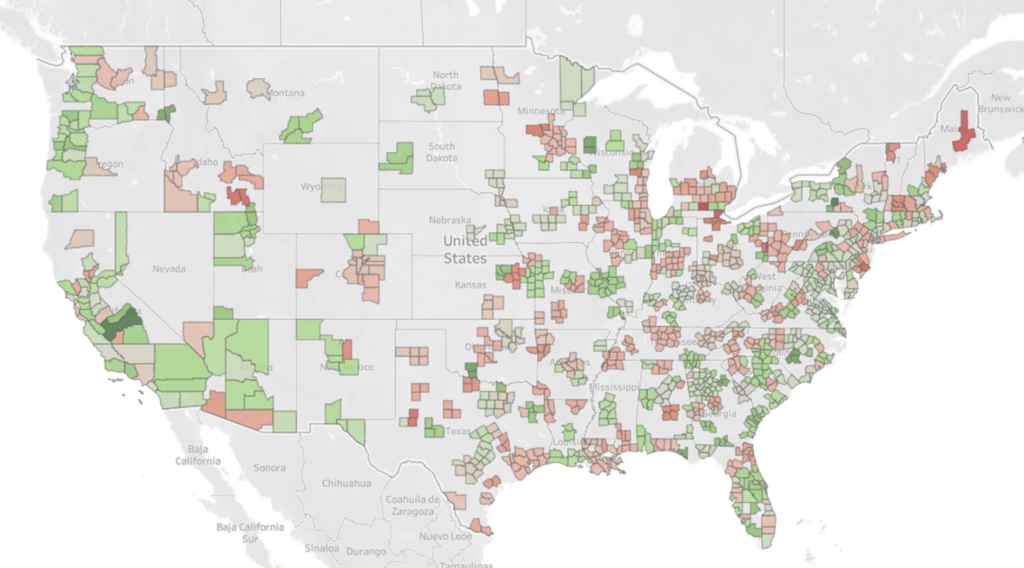

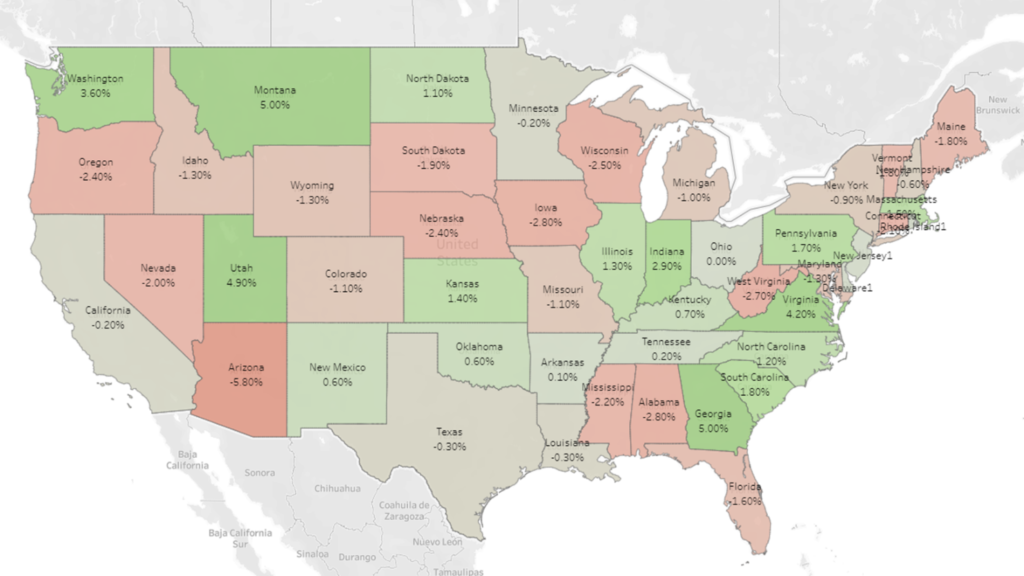

In the FY 2022 final rule finalized the routine wage index shifts that occur annually, have occurred for FY 2022 as well. Note the following two maps. The first shows the shift in wage index for Urban facilities by counties. The second shows the wage index shift for rural facilities by state. Note the redder a county or state is the more negative a shift has occurred from FY 2021 to FY 2022 and the greener, the more positive shift.

FY 2021 – FY 2022 Wage Index Change: Urban

FY 2021 – FY 2022 Wage Index Change: Rural

Keep in mind that CMS also finalized the full implementation of the OMB CBSA delineations. When the final rule takes effect on October 1st there will be some facilities whose wage indexes that had the 5% cap applied last year, who, after the cap is no longer in place, will feel the full effect. According to the wage index tables posted by CMS last year, there are precisely 367 facilities for whom a 5% cap was applied to their wage index change. We thought it would be interesting to take a look at those facilities specifically, to see what % change occurred between the 5% capped wage index last year and the fully implemented OMB CBSA delineated wage index in the final FY 2022 wage index table.

It is interesting that there are some facilities in this category that actually had a positive shift in their wage index from 5% capped to fully implemented OMB CBSA affected. 95% had a negative shift while only 5% had a positive change. It is no surprise that the CBSA formerly associated with Sibley County Minnesota takes the prize for the largest negative shift, coming in at -16%. Cumberland, Harnett and Hoke Counties NC had the largest positive shift of +6.1%. Here is what Sibley County’s rate will look like in FY 2022. Note the dramatic reduction compared to FY 2020 and 2021 capped with the 5% cap no longer in place.

FY 2022 rate with full OMB CBSA revisions applied.

As we approach FY 2022 with final rule now complete, facilities would be well served to look at this type of analysis for their own SNF. What happened to your wage index? If yours was not capped last year, what happened to it in FY 22 compared to FY 2021? Did your CBSA change last year? Was your wage index capped last year and what happened to in in FY 22? These are good questions to be asking. Now that the rates have been set for FY 2022, we can apply the finalized wage indexes to see what type of change you might expect in your rate this year.

It is prudent to think ahead based on what you might discover when you begin to find out the answers to these questions. Preparing in this way now for the how your facility will be affected is a good recognition that you have indeed not missed the forest for the trees.