Have you ever wondered just how CMS comes up with your Medicare Part A rate? Year in and year out, the rates shift, but what makes up the components of that rate and why does a shift occur each year?

Market Basket Update

Every year CMS updates the PPS rate based on changes in the market basket (the overall cost of goods and services that contribute to expenditures required to run and maintain a nursing facility). The market basket is described as a fixed-weight index because it answers the question of how much more or less it would cost, at a later time, to purchase the same mix of goods and services that was purchased in a base period. For FY 2022, the base period changed from 2014 to 2018. For this proposed rule, CMS is proposing a FY 2022 SNF market basket percentage of 2.3 percent based on a fourth quarter 2020 forecast of the proposed 2018-based SNF market basket

This market basket is then adjusted by a forecast error adjustment. Because many of the current Medicare payment systems update payments on a prospective basis, the market basket increases used in those updates are a forecast of what those increases will be. The actual market basket increase for a given period can be higher or lower than the forecasted increase available at the time a payment update is determined. This phenomenon is commonly known as forecast error. If the forecast is in error by 0.5% up or down, CMS is mandated to adjust the Market basket by the % error. For FY 2022, CMS is using the fourth quarter 2020 forecast of the proposed 2018-based SNF market basket.

For FY 2020 (the most recently available FY for which there is final data), the forecasted or estimated increase in the SNF market basket index was 2.8 percentage points, and the actual increase for FY 2020 is 2.0 percentage points, resulting in the actual increase being 0.8 percentage point lower than the estimated increase. Since the difference between the estimated and actual amount of change in the market basket index exceeds the 0.5 percentage point threshold, the FY 2022 market basket percentage change of 2.3 percent would be adjusted downward to account for the forecast error correction of 0.8 percentage point, resulting in a SNF market basket percentage change of 1.5 percent.

Usually, the only other adjustment to the Market Basket update each year is a multi-factor productivity adjustment (MFP). The MFP is defined as the 10-year moving average of changes in annual economy-wide private nonfarm business multi-factor productivity. This adjustment is intended to ensure that the annual market basket update also accounts for increases in provider productivity. For Fy2022 market basket updates, based on the data available for this FY 2022 SNF PPS proposed rule, the current estimate of the 10-year moving average of changes in MFP for the period ending September 30, 2022 would be 0.2 percentage points.

Therefore, for FY 2022, the proposed market basket update of 2.3%, that would be reduced by a 0.8% forecast error adjustment to 1.5%, will finally be reduced by the MFP adjustment of 0.2% to 1.3%

Another potential adjustment to the market basket update is facility specific and has to do with the SNF Quality Reporting Program (QRP) reporting requirements. Every year, SNFs are required to submit 100% of the MDS data necessary to calculate all SNF QRP measures on at least 80% of MDS assessments. If they do not meet this Annual Payment Update (APU) requirement CMS will require 2% reduction to their market basket update.

Finally, for FY 2022, CMS is proposing an Exclusion of Blood Clotting Factor (BCF) from Consolidated Billing. CMS has proposed to add “blood clotting factors indicated for the treatment of patients with hemophilia and other bleeding disorders . . . and items and services related to the furnishing of such factors to the list of items and services excludable from the Part A SNF PPS per diem payment, effective for items and services furnished on or after October 1, 2021.

This will affect the NTA and nursing base rates because BCF is a type of NTA and nursing resources are required to furnish this medication. After a 5-part calculation to determine the effect that excluding BCF from consolidated billing will have on these two components CMS has determined the following.

- an urban base rate deduction of $0.02, which would be applied as a $0.01 reduction to the proposed FY 2022 NTA base rate and a $0.01 reduction to the proposed FY 2022 nursing base rate.

- a rural base rate deduction of $0.02, which would be applied as a $0.01 reduction to the proposed FY 2022 NTA base rates and a $0.01 reduction to the proposed FY 2022 nursing base rate.

According to CMS, this exclusion from consolidated billing of BCF results in a total reduction in SNF spending of $1.2 million.

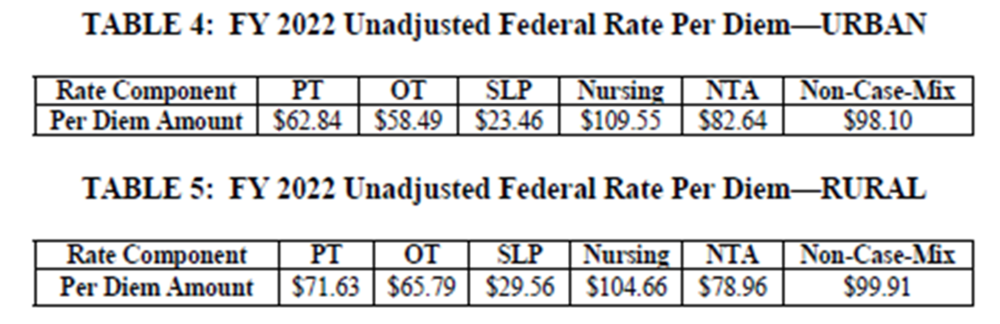

Base Rates

As a result of the above proposals affecting the FY 2022 SNF PPS rate, the tables below represent the final base rates that CMS is proposing for all 5 case mix adjusted categories. These posted rates have not been modified by any QRP APU adjustments. CMS indicates the overall economic impact will be $444 million in aggregate payments to SNFs for FY 2022.

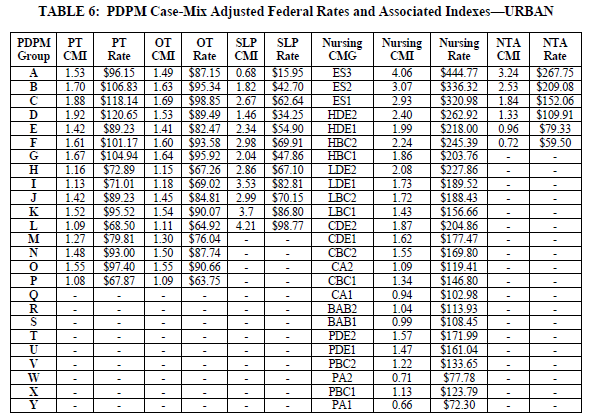

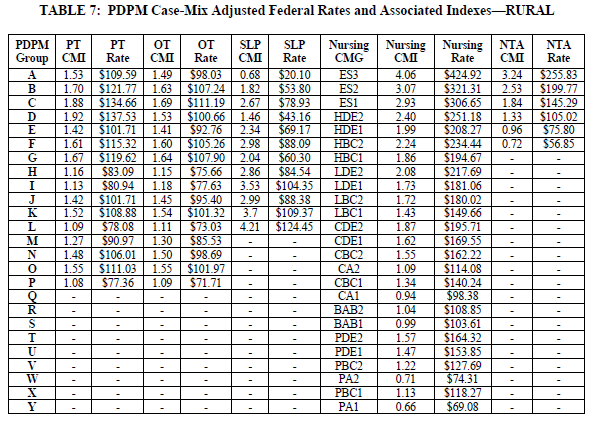

Once the base rates are established, each one is adjusted by a case mix index that is reflective of the resource use, or acuity associated with care provided to Medicare beneficiaries in SNFs at each of the 16 PT, 16 OT, 12 SLP, 25 Nursing and 6 NTA payment categories. The following tables reflect the final case mix adjusted rates that CMS is proposing for FY 2022. These rates are then adjusted by the wage index (see Part 2 of this blog series), and the case mix indexes which adjust these rates will be adjusted in some way by the 5% parity adjustment that CMS is proposing (See part 1 of this blog series).

Adjusted Rates

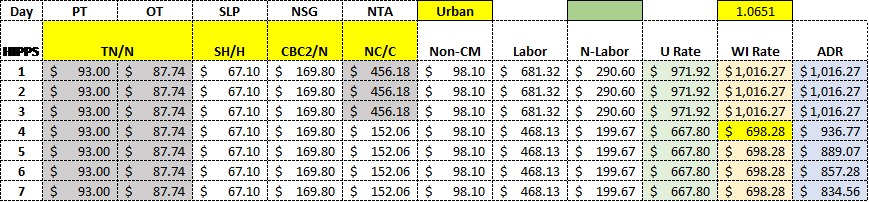

Now, let’s apply the rate setting process to an actual HIPPS and Wage index and see what we get. You will notice in the rate setting table below that we are using a HIPPS of NHNC. This would reflect the case mix adjusted rates for the following payment categories: PT – TN ($93.00), OT – TN ($87.74), SLP – SH ($67.10), NSG – CBC2 ($169.80) and NTA – NC ($456.18 days 1-3 and $152.06 day 4 and following). The Urban Non-Case mix group is the same for every Urban facility (98.10), see tables 6 and 7 above.

The Sum of these rates, $971.92, is divided into the labor-related ($681.32) and nonlabor-related ($290.60), portions. The labor-related portion of the rate (also discussed in Part 2 of this blog series) is multiplied by the wage index and added back to the nonlabor-related portion to arrive at the final wage index adjusted rate. In the example below the wage index adjusted rate is $1,016.27 for days 1-3 and $698.28 starting on day 4. These final rates are adjusted by Sequestration, Value Based Purchasing as applicable.

Your final rates will be specific to your geographical location and Sequestration, VBP and QRP adjustments. In a future blog post we will discuss CMS’ proposal to suppress the VBP adjustment for FY 2022. Knowing your rate structure is important for understanding your facility from an operational perspective and is key in the IPA decision making process. Keeping a rate sheet handy for each resident’s Part A stay is an invaluable way to ensure that you are making quality decisions surrounding your facility’s unique daily rate.