Among the many required updates that CMS is mandated to make each year related to the SNF PPS rate, there is one pesky little number that often gets lost in the shuffle. That number is the wage index. The wage index is an adjustment to the SNF PPS rate that accounts for regional differences in area wage levels and since the inception of the SNF PPS, CMS has used hospital inpatient wage data in developing a wage index to be applied to SNFs. Current and proposed wage index data may be found at the following website, https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/WageIndex

It is important to remember that the wage index data is based on Office of Management and Budget (OMB) definition of Core Based Statistical areas divided into Metropolitan and Micropolitan statistical areas i.e. Urban or Rural status.

For FY 2021, CMS finalized adoption of the revised OMB delineations identified in OMB Bulletin No. 18-04 in order to identify a facility’s urban or rural status. CMS believes that these updated OMB delineations more accurately reflect the contemporary urban and rural nature of areas across the country, and that use of such delineations would allow them to more accurately determine the appropriate wage index and rate tables to apply under the SNF PPS, in order to enhance the accuracy of payments under the SNF PPS.

The changes to the OMB statistical area delineations adopted for the wage indexes that affected the FY 2021 PPS included some new CBSAs, urban counties that would become rural, rural counties that would become urban, and existing CBSAs that would be split apart. Tables 11-14 in the FY 2021 final rule include Urban counties that would become Rural, counties that would gain Urban status, CBSA’s that change name or number and Urban counties that would move to another Urban CBSA.

Due to the significant effect these revised OMB delineations had on the prior wage indexes, CMS finalized a 1-year transition for FY 2021 under which they applied a 5% cap on any decrease in a SNFs wage index compared to its wage index for the prior fiscal year (FY 2020). It is critical to remember that this transitional cap only applied to FY 2021. Any reductions to the FY 2021 wage indexes that were capped at 5% will experience the full reduction in FY 2022.

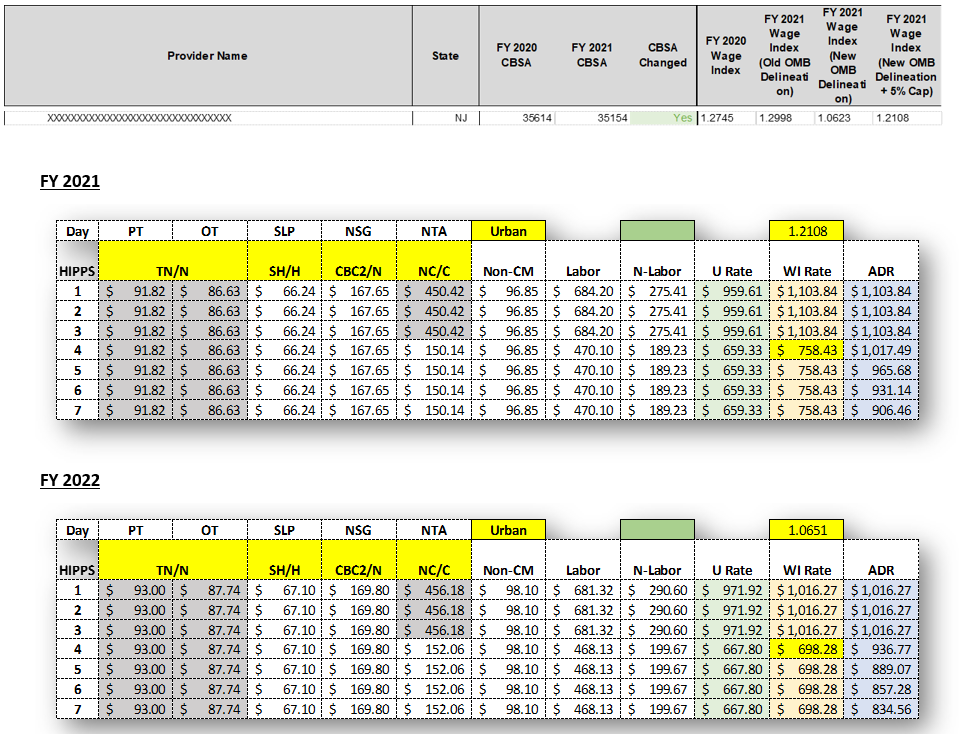

It is very important that you know how the OMB revisions for FY 2021 affected your wage index and whether or not your wage index was capped at 5% last year and whether you stand to experience additional reductions to your wage index in FY 2022. The example below shows the devastating effect of these changes for one CBSA. Note the change in the wage index, (FY 2021 5% capped – 1.2108, Proposed FY 2022 1.0651). Note also the effect that this reduction has on the FY 2022 rate (FY 2021 7-day average 906.46, FY 2022 Proposed 7-day average rate 834.56). A rate difference of $71.90/day will be hard to swallow.

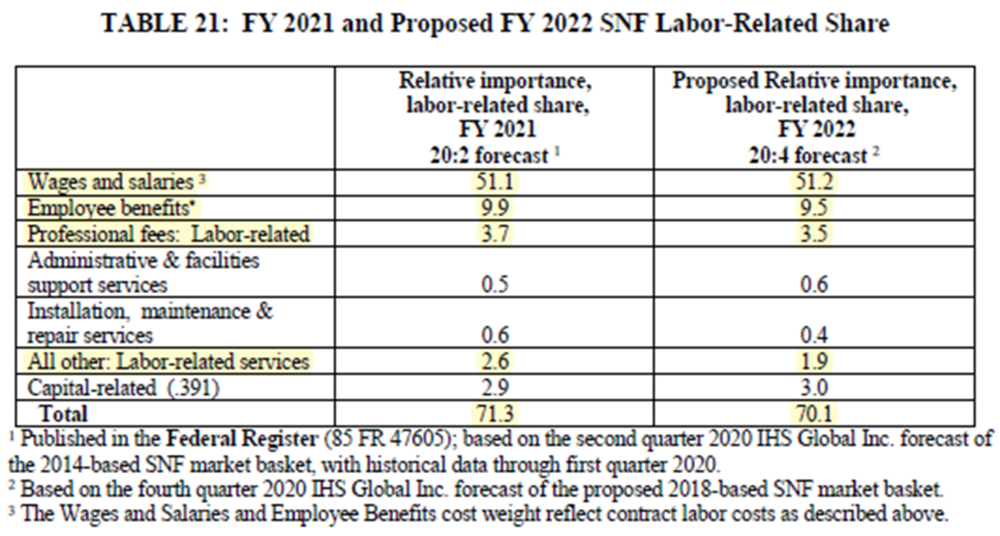

Another important but relatively unnoticed element of FY 2022 rate adjustment process is the labor related portion of the rate. The wage index as an adjuster of the PPPS rate relative to area wage levels makes a specific adjustment to the labor related share or portion of the PPS rate. In the rate tables above, you will notice that the 7th column is the labor related share. This portion of the rate is defined by CMS as those expenses that are labor-intensive and vary with, or are influenced by, the local labor market. Each year, CMS calculates a revised labor related share based on the relative importance of labor-related cost categories in the input price index.

Effective for FY 2022, CMS is proposing to revise and update the labor-related share to reflect the relative importance of the proposed 2018-based SNF market basket cost categories that they believe are labor-intensive and vary with, or are influenced by, the local labor market. For the proposed 2018-based SNF market basket these are:

(1) Wages and Salaries (including allocated contract labor costs as described above);

(2) Employee Benefits (including allocated contract labor costs as described above);

(3) Professional fees: Labor-related;

(4) Administrative and Facilities Support Services;

(5) Installation, Maintenance, and Repair Services;

(6) All Other: Labor-Related Services; and

(7) a proportion of capital-related expenses.

– CMS proposes to continue to include a proportion of capital-related expenses because a portion of these expenses are deemed to be labor-intensive and vary with, or are influenced by, the local labor market.

It is important to note that the proposed FY 2022 SNF labor-related share is 1.2 percentage points lower than the FY 2021 SNF labor-related share which was based on the 2014-based SNF market basket (FY 2021 – 71.3 vs. Proposed FY 2022 – 70.1). The major reason for the lower labor-related share is due to the incorporation of the 2012 Benchmark I-O data, primarily stemming from a decrease in the All Other: Labor-related services and Professional Fees: Labor-related services cost weights, and a decrease in the Compensation cost weight as a result of incorporating the 2018 MCR data. The table below shows the actual shifts associated with these portions of the labor related share.

So, don’t forget your wage index. There are potential major changes afoot for your facility’s wage index. Paired with the labor related share reduction and potential parity adjustments, the touted $444 million dollar increase that so many have been writing about may not be as golden as it appears. The time is now to be sure you are on your PDPM A game.