I love the summer. I look forward to it all year. In East Tennessee where I live, this time of year is especially beautiful. We are high up enough to escape the sweltering heat and humidity most days until the dog days come. It is green and lush here and the summer floral extravaganza is mesmerizing. I especially love sitting on the porch in the evenings and watching the prolific fireflies.

I must admit though, that this time of year has some melancholy aspects as well. We have passed the summer solstice so the days have begun to shorten slightly. Fall is on the way with shorter days and cooler weather.

And this has got me thinking about the diminishing SNF payment hidden in the FY 2023 proposed rule. Often, we think of rate reductions as having to do with sequestration and value-based purchasing. However, in a value-based payment universe there is more under the surface to consider.

Sequestration

Sequestration is back! Starting July 1, the full 2% sequestration will be levied against SNF claims. On December 10, 2021, President Biden signed the “Protecting Medicare and American Farmers from Sequester Cuts Act”. This act phases in the Medicare sequester cuts that paused during the COVID-19 Public Health Emergency (PHE). From April 1, through June 30, 2022, the providers saw a 1% reduction. The reduction returned to 2% on July 1, 2022. Providers will notice the difference in their remittance advice beginning with bills submitted for dates of service starting July 1.

Value-Based Purchasing

Value Based Purchasing (VBP): Until recently, all provider Medicare Part A rates were reduced by 2%. Providers could earn a portion of that back based on rehospitalization performance relative to past performance.

In the FY 2022 final rule, CMS modified this measure due to significant fluctuations in patient case volume and acuity. Under this policy, CMS assigned all participating SNFs a performance score of zero. This effectively equalized performance scores and payment multipliers for all providers. In other words, rehospitalizations had no effect on providers during this time.

Additionally, CMS reduced per diems for FY 2022 by 2 percent and “awarded” SNFs back 60% of that reduction. Put simply, facilities received a 1.2 percent payback.

Despite the universal payback it still means a 0.8% rate reduction. A big win for most providers but a potential significant loss for top performers. CMS has proposed to continue this policy through FY 2023. Further, CMS been clear that the program will resume as originally intended in FY 2024.

Furthermore, in the FY 2023 proposed rule, CMS intends to add 3 quality measures to the VBP calculation. These are in addition to rehospitalizations and will arrive in FY 2026 and 2027.

- Skilled Nursing Facility (SNF) Healthcare Associated Infections (HAI) Requiring Hospitalization,

- Total Nursing Hours per Resident Day Staffing (Total Nurse Staffing) measure and

- Discharge to Community (DTC) – Post-Acute Care (PAC) Measure for Skilled Nursing Facilities.

All three have their own baselines and performance periods. This significantly raises the bar for those hoping to recoup that 2%. Additionally, the baseline periods for all three of these new measures has already begun.

Quality Reporting

Quality Reporting Program (QRP): In 2014, congress enacted the IMPACT act. That gave LTCHs, home health, and IRFs a quality reporting program. This standardized quality reporting elements in the provider assessment tools. For SNFs, there are 13 QRP quality measures, 8 MDS-based measures, 4 claims-based measures and 1 NHSN measure. Two of these measures also affect a facility’s 5-star rating.

Since 2016, QRP reporting required SNF’s report 100% of the MDS data necessary to calculate all 8 MDS based measures. Since 2021, SNF’s must report 100% of the necessary NHSN data. In the FY 2023 proposed rule CMS has updated the CFR to codify the NHSN reporting requirement. If either of these thresholds are unmet, SNF’s lose 2% of the annual payment update (APU). This is the market basket update.

For FY 2022, this penalty would have resulted in a -0.8% update. In other words, those failing to meet the 2022 QRP reporting requirements receive 0.8% less than the previous year.

For FY 2023, the proposed Market Basket Update is 3.9%. Non-compliance in 2023 would mean only a 1.9% update to the rates. The pain for QRP reporting noncompliance will only be compounded with the proposed 4.6% parity adjustment.

Parity Adjustment

Parity Adjustment: In the 2023 proposed rule, CMS is proposing a 4.6% reduction to overall SNF payments. This equates to $320 million in aggregate reductions to SNF payment. CMS has indicated, “…parity adjustment recalibration would serve to remove an unintended increase in payments from moving to a new case mix classification system, rather than decreasing an otherwise appropriate payment amount.” That’s CMS-speak for PDPM was supposed to be revenue neutral.

Additionally, the proposal states that CMS will do this as a one-time adjustment to PDPM category CMIs in FY 2023. In the 2023 proposal CMS rejected any consideration of delaying the adjustment or phasing it in over several years.

This means that instead of a 3.9% Market Basket Update, the effect of the parity adjustment will be about -1.63%. This parity adjustment will be permanent.

The -4.6% adjustment that CMS intends to apply to each PDPM category CMI is also permanent. Any future updates will start there. The reductions keep piling up. But wait, there’s more.

Proposed Wage Index Adjustments

Proposed wage index adjustments: Each year CMS is required to adjust federal rates to compensate for differences in regional wages. CMS uses hospital wage data to do this and will continue this practice for FY 2023.

CMS acknowledges changes to the wage index can potentially destabilize and negatively impact certain providers. This is true even when labor market areas do not change. Additionally, fluctuations in an wage indexes occur due to external factors , such as the COVID–19 public health emergency (PHE).

For FY 2023 and onward, CMS is proposing a 5 percent cap on annual decreases to wage indexes. This would be regardless of the reasons for the decline. Wage indexes adjust the labor related portion of the rate.

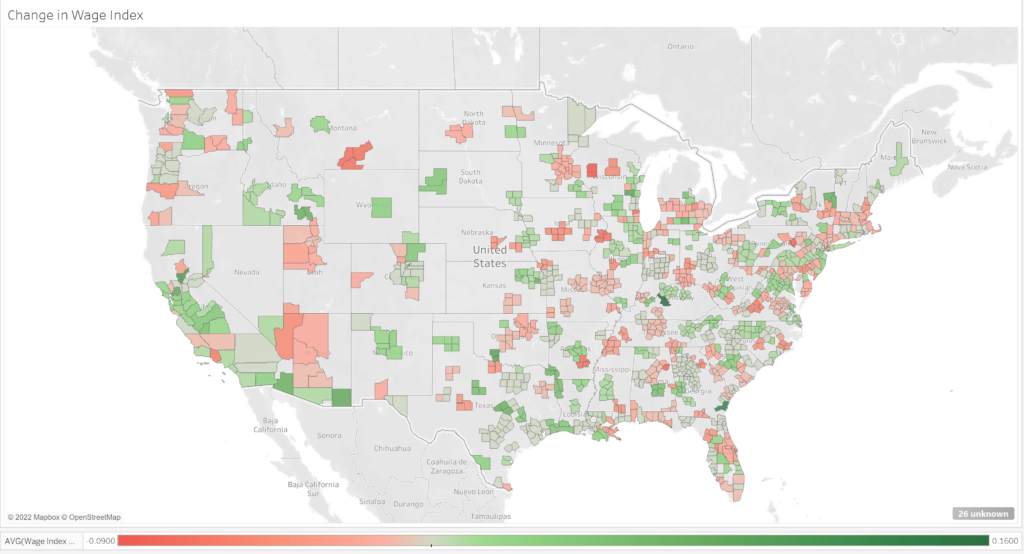

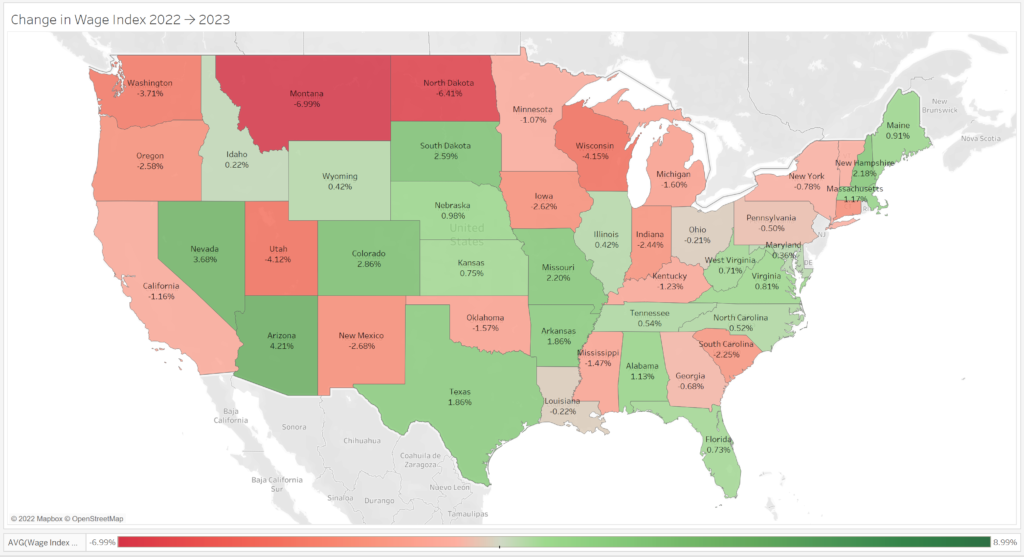

It’s always good to know the upcoming changes to your wage index. Here is a FY 2023 rate table for FY 2023 including all proposed adjustments. Below are some maps showing FY 2023 wage index changes.

Urban Wage Index

Urban: 59% of counties see a wage index reduction and 4% of counties are capped at 5%.

Rural Wage Index

Rural: 48% of states see a wage index reduction and 4% of states are capped at 5%

Staffing

Staffing: The FY 2023 proposed rule has a lot to say about staffing. One proposal is to add “Total Nursing Hours per Resident Day Staffing” (Total Nurse Staffing) to the VBP program. Another is to get stakeholder feedback on proposed staffing mandates while currently studying the feasibility of implementation.

These are in addition to the recently released phase 2 and 3 Requirements of Participation (ROP) guidance and State Operations Manual (SOM) revisions. The latter added new requirements for surveyors to incorporate the use of Payroll Based Journal data to inspections. According to CMS, this will better identify noncompliance with CMS’s nurse staffing requirements. These include lack of a registered nurse eight hours daily, and lack of licensed nursing for 24 hours daily. This guidance is intended to help to uncover instances of insufficient staffing and yield higher quality care.

Care Compare and 5 Star

Not included in the final rule, but relevant, both Care Compare and 5-Star will be refreshed in July. Both the new weekend staffing and turnover measures will be folded into each facility’s 5-star rating. This has the potential to have significant ongoing effects on individual facility 5-star ratings.

The 5-star rating itself does not have a direct financial impact on facility reimbursement. It does, however, have secondary effects which can have financial consequences. A 5-star rating can impact relationships with preferred provider networks, access to managed care networks and community reputation. These are hard to quantify but can be significant.

Let’s recap

It is important to take into consideration the sum of these reductions. They can and will accumulate.

- Sequestration: -2% rate adjustment

- Value Based Purchasing: -2% rate adjustment (-0.8 FY 2023)

- Quality Reporting: -2% adjustment to the APU for reporting non-compliance

- Parity Adjustment: -4.6% CMI adjustment FY 2023

- Wage Index Adjustments: – Location Specific, FY 2023 ranges – Rural: -0.21% to -6.99% (Capped at 5%). Urban: -0.01 to -8.655 (Capped at 5%)

- Staffing: 5-star adjustments July 2022, SOM revisions to survey guidance with potential CMP’s and possible future staffing mandates.

There’s much to consider here. Like the ebbing summer daylight, your PDPM rate is impacted by legislation and rule-making. Each of these changes have a common goal: value. Value, like the summer solstice, is an outside governance pulling facilities in one common direction. As well intentioned as these programs may be, the financial impact is real. Ensuring that your facility has the capacity to mitigate the negative financial effect is crucial.

Find out how Broad River Rehab can help. We would love to show you the difference our compassionate and knowledgeable teams can make. Contact us today or call us at (800) 596-7234 or (828) 774-5222