Although MPPR has been around since 2011, a lot of people are surprised just how big a role it plays in Part B reimbursement in skilled nursing. It’s a tool CMS has used to justify paying less for Part B therapy delivered in skilled nursing facilities. Here’s how.

How Part B Used to Work

Back in the good old days (prior to 2011) when we did Part B therapy we would bill CMS for the units of therapy we performed. We’d get a set amount for each CPT code we performed. (I’m simplifying here. There are a lot of hoops to go through to actually get paid and a lot of other ways CMS tries to reduce what they pay. We’ll ignore those for now.)

We need to get into a little detail here to understand how CMS sets the rates for a particular CPT code. I’ll keep this as simple as possible.

When CMS pays for a unit of a CPT code, they are really paying for three things:

-

The actual work

-

The cost of having a place to do the work (known as the practice expense)

-

The cost of malpractice insurance

Every CPT code we do has those three components built into it. CMS determines the relative value of each of these three components and assigns a weight to it. These weights are known as Relative Value Units or RVUs. This allows CMS to set the value of not just each type of treatment (CPT code) but also each of the three parts of the code.

The cost of labor, maintaining a place of business and buying malpractice insurance is not the same all over the country. So to account for that, each of the three RVUs is multiplied by a Geographic Price Index or GCPI. There are GCPIs for states, metropolitan areas, and cities. This gives fine-grained control over reimbursement.

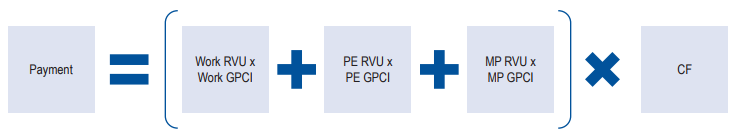

The three RVUs, multiplied by their corresponding GCPIs, are summed and then multiplied by a Conversion Factor. The conversion factor can be changed to adjust the entire Part B therapy budget all at once to account for things like general inflation. This is done annually.

This may sound complicated but it boils down to a simple formula: (Note: this image was taken from this excellent document by CMS.) Update: CMS has removed the document for unknown reasons. I was able to find a copy of it and posted it here.

A Simple Example

Let’s do a simple example. What is one unit of 97110 worth in say, Dallas, Texas. You can look up any CPT code in any geographic area using this tool.

| 97110 – Dallas, Texas | |||||

| RVU | GCPI | Total | |||

| Work | 0.45 | x | 1.012 | = | 0.4554 |

| Practice Expense | 0.40 | x | 1.014 | = | 0.4056 |

| Malpractice Insurance | 0.02 | x | 0.768 | = | 0.01536 |

| Subtotal | 0.87636 | ||||

| Conversion Factor | x | $35.9996 | |||

| Full Facility Price | = | $31.55 | |||

You can see if we wanted to do this calculation for a different city or state, we’d just need to change the things in the GCPI column (green items). A different CPT code would mean different values in the RVU column (blue items).

So for one unit of 97110 in Dallas in 2018, the full facility price is $31.55. This is often referred to as the full fee screen. For every unit of 97110 you did in Dallas, you’d receive $31.55. (Remember this is simplified, no sequestration, no co-insurance, etc.)

How Part B works now: MPPR

Fast forward to today: CMS has decided they will only pay full price for ONE unit per person per day. They call this idea the “Multiple Procedure Payment Reduction” or MPPR. It’s a good name because it does exactly what it says. It does not matter if the units are spread across multiple disciplines. If you do more than one unit of treatment in a day only ONE will be full reimbursed. Which one? The one with the highest Full Facility Price.

How much is the payment reduced? 50% of the Practice Expense (PE) is subtracted from all codes after the first unit. (I am defining “first unit” as the highest “Full Facility Price” here.)

I will not attempt to explain the reasoning behind reducing the practice expense portion of the reimbursement.

Let’s look at our example again but this time we’ll assume that the 97110 is the second unit provided. The first unit was also 97110.

| 97110 – Dallas, Texas (2nd unit) | |||||||

| RVU | GCPI | MPPR | Total | ||||

| Work | 0.45 | x | 1.012 | = | 0.4554 | ||

| Practice Expense | 0.40 | x | 1.014 | x | 0.5 | = | 0.2028 |

| Malpractice Insurance | 0.02 | x | 0.768 | = | 0.01536 | ||

| Subtotal | 0.67356 | ||||||

| Conversion Factor | x | $35.9996 | |||||

| MPPR Price | = | $24.25 | |||||

Notice that our new MPPR price of $24.25 is a 23.1% reduction from the full price of $31.55. Overall for our two units of 97110 day we’d be looking at a reduction of 11.6% for this day.

The more units you do in a day for a patient, regardless of discipline, the greater the percentage reduction in pay. Also, the MPPR calculation is done prior to all the other reductions we’ve ignored up until now. (sequestration and co-insurance namely)

You’re probably asking “How can I mitigate the MPPR?” The answer is you don’t really have a lot of choices. If clinically appropriate, you could spread your treatments over more days and do fewer units per day. That’s about it. On the bright side, if there is one, the MPPR allows you to perform more treatments under the therapy caps.

Because MMPR is a more complex concept, a lot of people in the industry tend to ignore it. Don’t make that mistake. MPPR can have a substantial impact on your Part B reimbursement.